pay indiana state property taxes online

Please contact your county Treasurers office. Main Street Crown Point IN 46307 Phone.

Indiana Property Tax Calculator Smartasset

Create an INtax Account.

. E-Check Visa Mastercard Discover and American Express accepted. If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale. Disclaimer Madison County Treasurers Office 16 E 9th St.

Building A 2nd Floor 2293 N. If you owed tax it will show the payment information and howwhen you decided to pay. Please direct all questions and form requests to the above agency.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Pay by phone toll free. Property Tax Payments - Search.

Indygov Pay Your Property Taxes This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. It looks like something has gone wrong. Tax Liabilities and Case Payments The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

Chemist. A convenience fee will be assessed 6. Take the renters deduction.

Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. Agriculture Indiana State Department of. If your Property is up for Tax Sale making payment online WILL NOT remove it.

Look for the state cover sheet with the Turbotax logo. Use Address Example. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction.

Only authorized banks can accept on-time payments. Claim a gambling loss on my Indiana return. INtax only remains available to file and pay the following tax obligations until July 8 2022.

Pay my tax bill in installments. ONLINE BANKING or PHONE Pay by creditdebit card or e-check at wwwbartholomewingov paperless billing. You need to come in the office and bring cash or certified funds.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. Online Payments - LPC - La Porte County Indiana Online Payments Home Online Payments La Porte County government accepts credit or debit card payments through Central Payment Corporation a third party agency. Search for your property Search by address Search by parcel number.

Have more time to file my taxes and I think I will owe the Department. Have more time to file my taxes and I think I will owe the Department. Transaction Fees are Non-Refundable.

Search for your property. PAY TAXES ONLINE at wwwpaygovus We are unable to accept credit card payments at this time until all on-time payments are posted NOTE. Please contact the Indiana Department of Revenue at 317 232-1497.

Youll be redirected to InTime or the Indiana Taxpayer Information Management Engine. 6-1 on the file. 2022 Primary Election DEPARTMENT PHONE LIST Employment Opportunities Pay Traffic Citation Pay Court Fines and Fees Warrant Search Court Date Lookup Pay Property Tax Online Property Tax Information.

If you have any questions please call the office. After selling to a corporation buyers in Indiana get a year after the sale to pay redemption expenses and repossess their homes. Community.

Contact the Indiana Department of Revenue DOR for further explanation if you do. Use First Name Last Name Example. Read the state payment instructions carefully since most states cannot be paid from within the TT system and requires additional steps.

This tax bill is the Only Notice you will receive for payments of BOTH INSTALLMENTS of your taxes. 220 N Main Street Room 226. Beginning July 7 2022 no new registrations will be accepted via INtax.

Check the printout or PDF of your return. Allen County Treasurer 1 East Main Street Suite 104 Rousseau Centre Fort Wayne IN 46802. Animal Health Board of.

Room 109 Anderson IN 46016 765 641-9645. VISA Debit 395 All other plastic 260 of total tax. Call 855-423-9335 with questions.

100 W Main St OR. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247.

The transaction fee is 25 of the total balance due. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. FirstNameJohn and LastName Doe OR.

Full and partial payments accepted. 183335552227774003 Numbers Only Please use only 1 Search Option at a time. If you dont have a bill or.

Click on Make Payment or Establish Payment Plan in the navigation bar. Payments may be made on line 24 hours a day. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Know when I will receive my tax refund. Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. This search may take over three 3 minutes.

Payments may be made using Visa MasterCard or Discover creditdebit cards. How Long Can You Go Without Paying Property Taxes In Indiana. To View Tax Bill and other Property Tax info.

Welcome to INtax The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Make sure you are paying for local payments Enter our location information Indiana Vanderburgh County Follow the directions online Disclaimer. Use 18 Digit Parcel Number Example.

But dont worry were working to get it back on track. Scroll down and navigate to Make a Payment in the Payments section. The state Treasurer does not manage property tax.

There are several ways you can pay your Indiana state taxes. Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E 9th St. M-F 800 am - 500 pm.

Find Indiana tax forms.

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

About The Local Tax Finance Dashboard Gateway

Property Taxes By State Embrace Higher Property Taxes

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Indiana Sales Tax Small Business Guide Truic

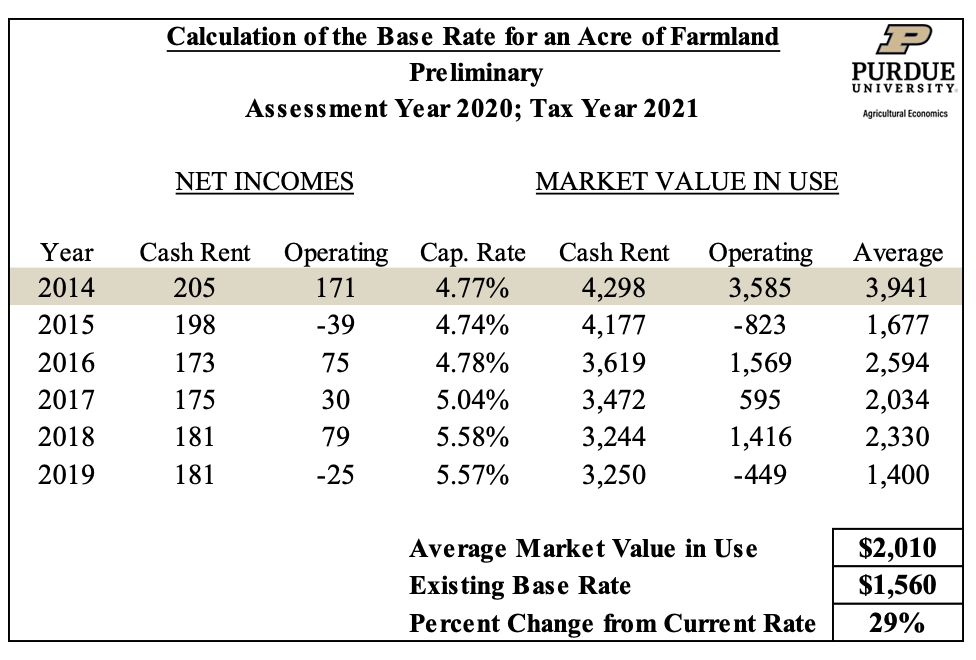

Farmland Assessments Tax Bills Purdue Agricultural Economics

Dor Indiana Extends The Individual Filing And Payment Deadline

Treasurer Johnson County Indiana

About The Local Tax Finance Dashboard Gateway

State Income Tax Rates Highest Lowest 2021 Changes

Where S My State Refund Track Your Refund In Every State Taxact Blog

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy